Advertisement

Some countries offer very low or even no taxes to foreign businesses and individuals. These places are called tax havens. They attract wealthy people and companies who want to lower their tax bills, often in ways that are legal but controversial. Tax havens spark debates about fairness, transparency, and the way governments handle international money. Understanding what defines a tax haven sheds light on why they continue to exist and why so many governments and organizations around the world argue about their role in the global economy.

A tax haven is a country or territory that charges little or no tax on certain types of income, usually aimed at foreigners. These places make it easy to set up companies, open bank accounts, and register trusts without much disclosure about who actually owns them. Privacy laws in tax havens often shield this information from other governments, which makes them appealing for hiding money or cutting taxes.

Some tax havens are small islands or microstates, while others are larger economies offering targeted benefits. The defining feature is not only low taxes, but also the secrecy and flexible legal structures that let money sit there with little oversight. Often, profits or income are shifted on paper to a tax haven, even though the business happens elsewhere. This practice, called profit shifting, is common among multinational corporations seeking to lower their taxes in the countries where they actually operate.

People sometimes confuse tax havens with countries that simply have low taxes. The difference is that tax havens design their laws to attract foreign money with few questions asked. For example, a company might register an office in a tax haven without hiring anyone or running any real operations there. The country benefits from registration fees, and the business pays less tax elsewhere.

The biggest reason people and companies use tax havens is to pay less tax. Wealthy individuals can shelter investments, inheritances, or personal income. Corporations use tax havens to lower taxes on profits through creative accounting and by exploiting loopholes in international laws. Much of this is legal, though often controversial.

Privacy is another reason. Many tax havens have strong confidentiality laws that make it hard for foreign authorities to track down who owns what. This appeals to those who value discretion, but it has also made tax havens a target of criticism for hiding stolen or undeclared wealth.

Globalization has made it easier to move money around. Digital banking and legal services allow someone to set up an offshore company without ever visiting the tax haven. As a result, huge sums of money are held offshore, depriving other countries of tax revenue they would otherwise collect.

Tax havens create an uneven playing field. Ordinary taxpayers and smaller businesses usually have no way to access such arrangements, while the wealthy and multinational corporations often have the resources to do so. This has raised concerns about fairness and inequality.

Governments lose billions each year as profits and fortunes are moved offshore. This can result in higher taxes on those who can't avoid them or cuts to public services. Developing countries are particularly hurt because they depend more on corporate taxes and have fewer resources to track hidden wealth.

Some argue that tax havens attract investment and encourage competition among countries. Others say the cost in lost revenue and weakened public trust outweighs any benefits.

International efforts to curb tax havens have increased in recent years. Groups like the OECD have pushed for greater transparency, requiring countries to share more information and close profit-shifting loopholes. New agreements are being drafted to set minimum corporate tax rates globally, making it harder for companies to move profits just to pay less tax.

Even so, tax havens remain popular. Many have adapted their laws to meet new rules while still offering low taxes. For example, some now require more reporting but keep corporate tax rates minimal. This shows how difficult it is to eliminate tax havens altogether.

Tax havens are unlikely to disappear soon. They are deeply rooted in the global financial system. For some small economies, offering tax haven services provides jobs and income. At the same time, political pressure and public awareness have grown, putting these jurisdictions under greater scrutiny.

New international agreements may reduce the benefits of using tax havens, making them less appealing over time. More cooperation among governments is expected, with automatic sharing of financial information and penalties for countries that don’t comply. Technology is also making it easier for authorities to detect tax avoidance schemes.

Individuals and companies may have to weigh reputational risks alongside financial ones when considering tax havens. Attitudes toward fairness in taxation are shifting, and governments are more determined to enforce rules against aggressive tax planning.

For now, tax havens remain part of the global economy, reflecting the tension between national tax policies and a world where money moves easily. Whether they change significantly will depend on how effectively countries coordinate and enforce reforms.

Tax havens are more than just low-tax countries. They combine minimal taxation with secrecy and flexibility, drawing wealth from around the world. People and companies use them to save on taxes and maintain privacy, which has fueled debate over fairness and transparency worldwide. They influence economies by reducing tax revenues and widening inequality, yet they continue to adapt despite international reforms and growing global scrutiny. The future of tax havens depends on stronger cooperation, enforcement, and public expectations around fairness. Understanding how they operate sheds light on larger questions about money, laws, and responsibility in a connected world.

Advertisement

Experience the best road trips in Portugal across beaches, cliffs, and valleys—ideal for a calm and scenic getaway.

What a non-conforming loan is, how it works, and when it makes sense to use one. Understand key differences from traditional loans and explore options like a jumbo loan

Take a break from Cardiff with 4 peaceful day trips to beaches, trails, forests, and coastlines perfect for fresh air.

How the custom alerts feature on Groww keeps you updated on your investments with timely notifications, making decisions easier and more informed

Plan your first trip to Napa Valley with this calm, scenic travel guide focused on nature, wellness, food, and relaxation.

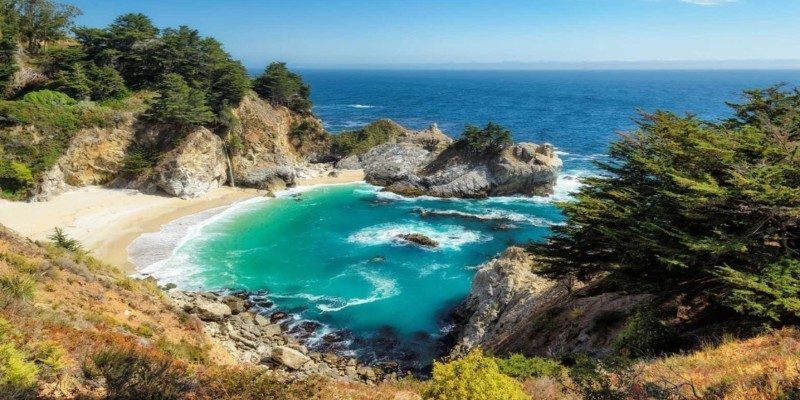

Explore the best day trips from San Francisco with this detailed guide. Discover coastal views, redwood forests, and charming small towns perfect for quick escapes

What a VA Certificate of Eligibility is, why it's required, and how to get one to access your VA loan benefits for homeownership

Visiting Nagano for the first time? Here’s a travel guide covering nature, food, and places to explore across the region.

Want to teach your kids about investing but don’t know where to start? This clear, practical guide helps parents build a strong financial foundation early—no jargon, just real-life steps that work

How breed influences pet insurance costs and why some pets are more expensive to cover. Understand breed-specific health risks and make informed choices for your pet’s care

Navigate all NYC airports with ease using this traveler’s airport guide for smooth connections.

Explore the benefits of pet insurance that doesn’t increase with age. Learn how steady premiums can help you plan your pet’s care without worrying about rising costs