Advertisement

Taxes often confuse people, especially when similar terms are involved. In India, many hear about TDS and TCS in their financial dealings but aren’t sure what sets them apart. Both involve collecting tax at the source of a transaction, yet they differ in purpose, who collects them, and when they apply. Learning the difference between TDS and TCS helps individuals and businesses follow tax laws and avoid mistakes. This article breaks down what each means, how they work, and where they diverge, explained clearly and simply.

TDS, or Tax Deducted at Source, is one of the simplest ways the government collects tax right when income is earned. Instead of waiting for you to pay taxes at the end of the year, a part of your income is withheld by the person making the payment — known as the deductor — and sent straight to the government. What you actually receive is the remaining amount after this deduction.

Take, for instance, your salary. Every month, your employer estimates your total annual income, deducts a certain amount as TDS from your paycheck, and deposits it with the tax authorities. Banks do something similar by deducting TDS on interest from fixed deposits if it crosses a set limit.

The deductor gives you a certificate showing how much tax they deducted, which you can claim as a credit when filing your income tax return. If too much was taken out, the excess gets refunded. TDS applies to salaries, rent, contractor payments, commissions, and more, with rates varying by the type of payment and the recipient's details.

TCS stands for Tax Collected at Source. Here, the seller collects tax from the buyer at the time of sale and pays it to the government. The buyer pays the tax as part of the purchase price, and the seller issues a certificate stating the amount collected.

TCS applies to specific transactions listed in the Income Tax Act. For example, sellers of scrap, minerals, timber, and forest produce are required to collect TCS. It also applies to sales of motor vehicles above a certain value, remittances abroad, and foreign tour packages.

For instance, when a car dealer sells a car worth more than ₹10 lakh, they collect a set percentage as TCS from the buyer at the time of purchase. Later, the buyer can adjust the TCS against their tax payable while filing returns. If no tax is due, the buyer can claim a refund.

The responsibility to collect and deposit TCS rests entirely with the seller. Like TDS, the applicable rates vary depending on the type of transaction and the buyer’s details. Higher rates apply if the buyer does not provide a valid PAN. TCS is a way to track certain kinds of purchases and ensure taxes are collected upfront in transactions that are otherwise harder to monitor.

Though both are designed to collect tax early, TDS and TCS function in very different contexts. Understanding these differences can help avoid errors in compliance.

The first difference lies in who is responsible. In TDS, the payer deducts tax from the income before paying the recipient. In TCS, the seller collects tax from the buyer at the time of selling specified goods or services.

The kinds of transactions covered also differ. TDS has a broader scope and applies to most income payments like salaries, rent, and professional fees. TCS, however, is limited to specific goods and services identified in tax laws.

Timing is another distinction. TDS is deducted before payment is made to the recipient, while TCS is collected at the point of sale.

From the recipient or buyer’s point of view, TDS reduces the amount they receive upfront because tax is already deducted. In TCS, the buyer pays tax along with the purchase price and later adjusts it against their final tax liability.

The compliance burden is different, too. TDS obligations fall on the payer, who must deduct, deposit, and report. TCS responsibilities fall on the seller. Both require issuing certificates and keeping proper records.

Although both mechanisms fall under the Income Tax Act, their objectives vary slightly. TDS focuses on capturing tax on income when it’s earned, while TCS ensures tax is collected on specific sales when they happen.

Understanding the difference between TDS and TCS helps individuals and businesses fulfil their tax obligations correctly. For individuals, knowing what TDS is helps keep track of tax already deducted and avoid paying extra while filing returns. For businesses, knowing when TCS applies helps them stay compliant with collection requirements.

If you are an employee, freelancer, or someone earning interest income, you are more likely to deal with TDS, since it applies to most income streams. If you run a business dealing in scrap, timber, minerals, or high-value cars, TCS is more relevant to you. Some businesses may need to handle both, depending on what they do.

Keeping certificates, filing returns accurately, and reconciling the amounts deducted or collected ensures you don't pay more than you owe. Many buyers overlook the TCS credit available to them, ending up paying more tax than necessary.

Both TDS and TCS contribute to a more transparent tax system by ensuring that taxes are collected upfront, reducing the chances of evasion. Understanding how each works and when it applies saves time and prevents unnecessary disputes or penalties.

TDS and TCS are two ways the tax system collects revenue in advance, but they operate in different situations. TDS applies to income that is deducted before payment, while TCS applies to certain sales, which are collected at the time of purchase. Both help improve compliance and make tax collection more efficient. Understanding the difference between TDS and TCS helps people and businesses know their roles, whether deductor, collector, or recipient. Staying aware of these obligations makes tax filing easier and ensures you only pay what you’re supposed to. Clear records and timely actions keep you on the right side of the law.

Advertisement

Discover the best sugar stocks in India 2023 with detailed insights into top-performing companies. Explore how the sugar industry in India offers investors unique opportunities

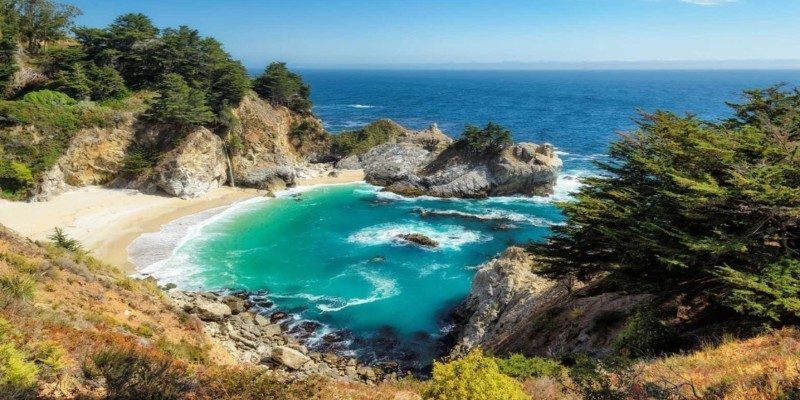

Take a break from Cardiff with 4 peaceful day trips to beaches, trails, forests, and coastlines perfect for fresh air.

Compare Amsterdam’s Rijksmuseum and Van Gogh Museum based on layout, vibe, visitor experience, and artistic focus.

Explore the best low-rate savings account alternatives to help your money grow faster without taking big risks. Learn smarter ways to save and earn more

Plan a summer trip to Coastal Georgia’s islands with tips for lodging, sunny beaches, trails, dining, and family fun!

Use this helpful guide to explore Louisville, Kentucky using public transport and walking.

What a VA Certificate of Eligibility is, why it's required, and how to get one to access your VA loan benefits for homeownership

What a tax haven is, how it works, and its impact on global finance. Learn why individuals and companies use tax havens and how they shape international taxation

How breed influences pet insurance costs and why some pets are more expensive to cover. Understand breed-specific health risks and make informed choices for your pet’s care

Want to teach your kids about investing but don’t know where to start? This clear, practical guide helps parents build a strong financial foundation early—no jargon, just real-life steps that work

Discover the top 12 things to do in Honolulu, from scenic hikes to markets, coastal walks, and tropical garden visits.

Explore the best day trips from San Francisco with this detailed guide. Discover coastal views, redwood forests, and charming small towns perfect for quick escapes