Advertisement

Filing your taxes can feel like ticking boxes and moving on, but sometimes an unexpected income tax notice can disrupt your plans. Many people believe they’ve done everything right, yet a letter still arrives from the tax department, leaving them confused or even anxious. Such notices are sent out for several reasons, not always for something serious or wrong. Understanding why the tax office reaches out helps you respond better and avoid repeating mistakes. Let’s break down the most common reasons you might get an income tax notice, explained in clear terms without unnecessary jargon.

One of the most frequent reasons behind an income tax notice is a mismatch between the income you declare and what is reported by third parties. Employers, banks, mutual fund houses, and other entities submit annual statements to the tax department about payments they’ve made to you. If your tax return does not reflect the same figures, the system flags this difference and may generate a notice. For example, you might forget to report interest earned on fixed deposits or some freelance income. Even small amounts can trigger scrutiny if they appear in the department’s records but not in yours.

The tax department closely monitors high-value transactions. Cash deposits above certain limits, purchasing property or shares worth significant sums, or making large credit card payments can all draw attention. Even if these transactions are fully legitimate, you might still get a notice asking you to explain the source of funds. For instance, depositing a large cash gift from a relative without mentioning it in your return might prompt the tax office to seek clarification. Keeping documentary evidence ready for such transactions makes it easier to respond.

If your income crosses the taxable threshold in a given year and you fail to file a return, it is very likely that the tax department will notice. Since most financial activities are already reported to them through linked accounts and PAN, skipping your return doesn’t usually go unnoticed. Even if tax has been deducted at source (TDS) by your employer or bank, filing your return is still necessary when you meet the filing criteria. Ignoring this obligation often leads to a notice reminding you to comply.

Another common reason people receive notices is errors in claiming deductions or exemptions. Declaring an ineligible deduction, claiming more than what is allowed under a particular section, or submitting incorrect documentation to support a deduction can all be questioned. For example, some taxpayers claim full house rent allowance (HRA) even though they live in their own house, or they overstate investments under Section 80C. When such discrepancies appear during verification, the tax office issues a notice asking for justification.

If you hold foreign bank accounts, investments, or property and fail to disclose them while filing, you risk receiving an income tax notice. Global information sharing agreements between countries make it easier for the tax department to track such holdings. Many people overlook small foreign income or assume it doesn’t need reporting if earned abroad, but under Indian tax law, such earnings and assets must be declared if you are a resident taxpayer. Non-disclosure can even invite penalties beyond a simple notice if it appears deliberate.

Although the demonetisation exercise is no longer in the news, the tax department continues to scrutinise cases where individuals deposited large sums of cash during that period. If you deposited cash beyond your known sources of income and didn’t offer a satisfactory explanation earlier, you might still receive a notice seeking further details. Many such cases are still under review as part of long-term compliance drives.

Sometimes, notices are generated due to mistakes or mismatches in tax deducted at source (TDS) or advance tax payments. If your employer or bank deducts TDS but does not deposit it properly or files an incorrect TDS return, your tax credit might not show up correctly on your Form 26AS or AIS (Annual Information Statement). In such cases, even though the fault is not yours, the notice still requests that you explain or rectify the return. Keeping an eye on your TDS records and correcting them quickly helps avoid unnecessary correspondence.

Not all notices are based on specific errors or omissions. The tax department sometimes selects returns for random verification under its scrutiny process. This is part of routine checks to ensure compliance and does not always imply a mistake. The department usually asks for supporting documents for certain claims or proof of income to verify details submitted in your return. Responding accurately and providing the requested documents usually closes the matter without further action.

While receiving an income tax notice can feel unsettling, it’s worth remembering that not all notices mean trouble. Many are simply requests for clarification or reminders. The key is to read the notice carefully, understand what is being asked, and respond within the specified time frame. Keep all your records, such as salary slips, investment proofs, bank statements, and purchase agreements, organised so you can reply confidently. If you’re unsure how to handle a notice, consulting a tax professional can save time and avoid errors in your response.

An income tax notice is often just a way for the tax department to clear up discrepancies or seek clarification, not necessarily a sign of wrongdoing. Knowing the reasons why such notices are sent—like mismatched income, high-value transactions, non-filing, or incorrect claims—can help you prepare better and avoid future notices. Staying honest in your declarations and keeping clear records goes a long way in making tax compliance less stressful. A calm, timely response backed by proper documentation usually resolves the matter without much difficulty.

Advertisement

How breed influences pet insurance costs and why some pets are more expensive to cover. Understand breed-specific health risks and make informed choices for your pet’s care

Plan your first trip to Napa Valley with this calm, scenic travel guide focused on nature, wellness, food, and relaxation.

How to calculate savings account interest with clear, simple steps. Understand how your balance, rate, and compounding affect your earnings, and use a savings interest calculator for quick estimates

Use this helpful guide to explore Louisville, Kentucky using public transport and walking.

Thinking about banking with Citibank? Learn about account structures, fees, customer support, and Citibank account benefits so you can make informed financial choices

Visiting Nagano for the first time? Here’s a travel guide covering nature, food, and places to explore across the region.

Explore the windfall tax effect on crude oil prices, its influence on production, supply, and market reactions, and how energy market policy decisions impact long-term trends

Hike the Azores with our guide to the best scenic trails, views, and island adventures.

Want to teach your kids about investing but don’t know where to start? This clear, practical guide helps parents build a strong financial foundation early—no jargon, just real-life steps that work

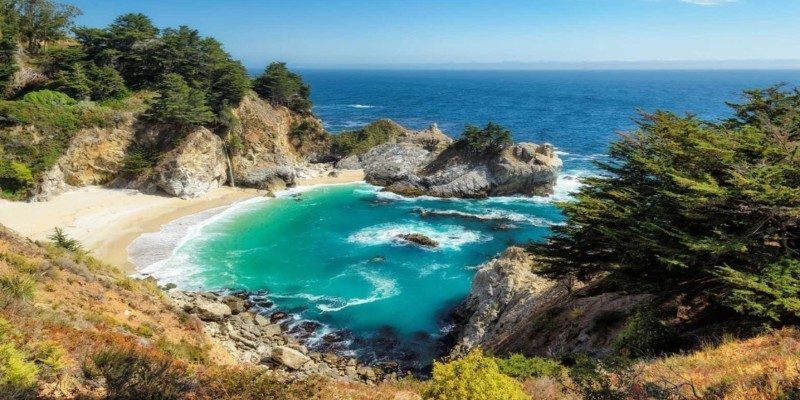

Explore the best day trips from San Francisco with this detailed guide. Discover coastal views, redwood forests, and charming small towns perfect for quick escapes

Prepare for your San Francisco visit with local tips, weather info, and travel insights.

Discover the prettiest places across Canada, from lakes and cities to wild mountain ranges.